Should lawyers protect clients from wire transfer fraud? I say YES!

By Michael Wasserman

In 2017, the FBI reported that wire transfer fraud was up 480% in real estate transactions. It’s a frightening number.

Yet more and more, I’ve heard that real estate lawyers won’t discuss transfer instructions with clients—that they leave itto the title company to avoid the responsibility and liability. What?!

This irks me to no end. A lawyer’s job is to protect clients, not to pass the buck or ignore a problem.

That said, my firm provides our clients with very specific measures to avoid wire transfer fraud which, to ensure security, we won’t publish on this blog. While we don’t provide wire transfer instructions (the title company sends those), you can be assured that our top priority is proactively protecting our clients’ transactions.

Ok, I’ll step off the soap box. Please check out our blog with detailed tips to keep wire transactions secure. But here’s a quick reminder: If you have any doubt, check it out. Hey, that even rhymes.

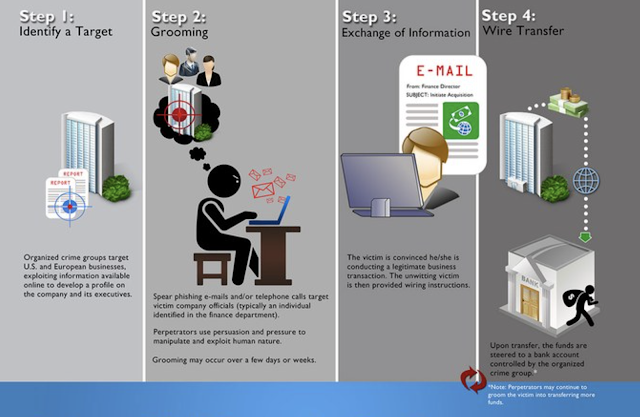

Common tactics of wire-transfer fraudsters, courtesy of the FBI.

Common tactics of wire-transfer fraudsters, courtesy of the FBI. - Double check routing, account numbers and the name of the intended recipient. Even one incorrect digit can result in wire transfer fraud.

- Be suspicious of duplicate or last-minute requests. Especially if the request is urgent—there is always time to verify.

- Do not use the email, phone number or link in a suspicious or last-minute request. Call or forward it to our firm or your banking institution to confirm.

Learn more:

Zoiks! Real estate scams up 480%

Cyber-Enabled Financial Fraud on the Rise Globally

Stay Informed

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.