Brokers, when clients ask about the new title company disclosures...

Here’s an important update for real estate brokers.

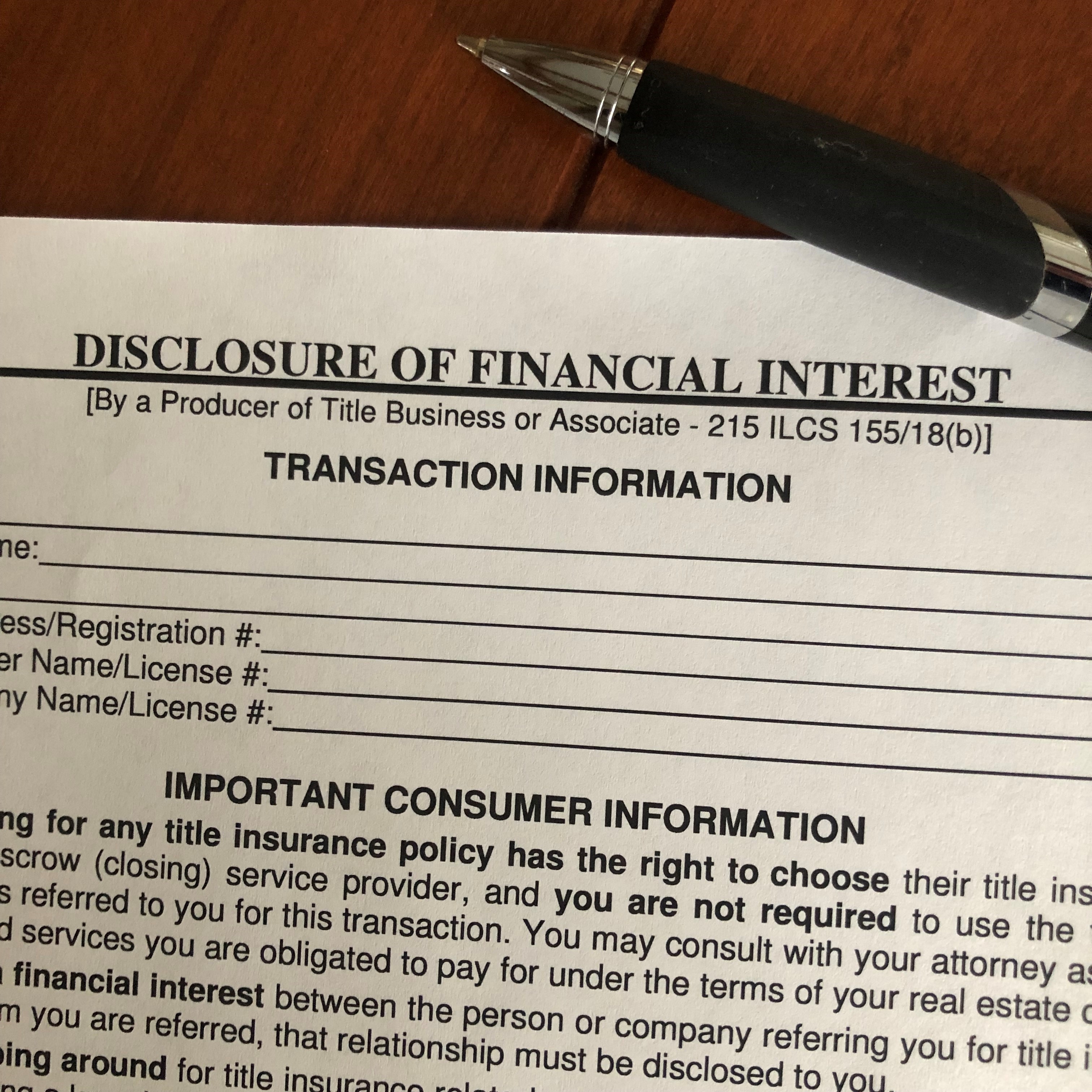

As of March 1, 2022, there will be a change in the Disclosure of Financial Interest form that Illinois title insurance producers (sellers’ lawyers, some brokerages, etc.) must provide to consumers as they contemplate title insurance. These ‘producers’ include our firm.

The new disclosure form will:

Here are some likely questions:

Who determines the title fees? The title companies do. They publish menus (rate cards) that spell out premiums and related fees. Title companies watch each other closely so their premiums are comparable and competitive. No one wants to price their services above market.

Should clients shop around for title insurance? Of course. And our firm can help. We collect several companies’ rate cards and are happy to share them with our clients and you.

However, shopping around is not expected to lead to a cost difference. Even if the client calls the title company directly, they will likely be quoted from the same rate card. Premiums should be the same whether a law firm is cut in or not.

Why use the attorney-recommended title company? Our firm only works with the companies we consider to be best in class, based on superior underwriting and closing staff.

The relationship with our preferred title companies allows our firm to:

What if bifurcation is necessary or desired? It can get complicated. Bifurcated deals require two closings. Two closings require redundant and possibly conflicting paperwork. Two underwriters from two companies, who may not agree on the same underwriting decisions. (What may be acceptable to the lender's underwriter may not satisfy the seller's). Two companies may also incur two sets of fees.

Why do the lawyers get such a large percentage? This is the real crux of the matter.

This is a lot of information to digest, and you may have more questions. If so, please don’t hesitate to contact me to discuss in more detail.

As of March 1, 2022, there will be a change in the Disclosure of Financial Interest form that Illinois title insurance producers (sellers’ lawyers, some brokerages, etc.) must provide to consumers as they contemplate title insurance. These ‘producers’ include our firm.

The new disclosure form will:

- State the estimated cost of the (seller-paid) owner’s title insurance policy and the (buyer-paid) loan policy.

- Call out the amount of money the producer (seller's attorney) will receive.

- Urge consumers to shop for title insurance or to at least consider doing so.

Here are some likely questions:

Who determines the title fees? The title companies do. They publish menus (rate cards) that spell out premiums and related fees. Title companies watch each other closely so their premiums are comparable and competitive. No one wants to price their services above market.

Should clients shop around for title insurance? Of course. And our firm can help. We collect several companies’ rate cards and are happy to share them with our clients and you.

However, shopping around is not expected to lead to a cost difference. Even if the client calls the title company directly, they will likely be quoted from the same rate card. Premiums should be the same whether a law firm is cut in or not.

Why use the attorney-recommended title company? Our firm only works with the companies we consider to be best in class, based on superior underwriting and closing staff.

The relationship with our preferred title companies allows our firm to:

- Discover and resolve title problems earlier in transactions.

- Access their closing resources to quickly and efficiently resolve title and closing issues.

- Have more control over the closing process to give clients greater flexibility and convenience in their transactions.

- Facilitate smoother communications, signings, and closing disbursements.

- Tend to be out-of-state businesses with no physical presence in Chicago.

- Use low paid, independent contractors for signings.

- Closings take days—not hours because those contractors do not have check-writing authority.

- Checks are cut after signed documents are sent back to wherever.

- Disbursements are delayed. Clients have waited weeks for the return of over-deposits, and up to a year or longer for recorded documents.

- Communications are (even by title company standards) abysmal.

- If things go sideways, there is no one to be held accountable.

What if bifurcation is necessary or desired? It can get complicated. Bifurcated deals require two closings. Two closings require redundant and possibly conflicting paperwork. Two underwriters from two companies, who may not agree on the same underwriting decisions. (What may be acceptable to the lender's underwriter may not satisfy the seller's). Two companies may also incur two sets of fees.

Why do the lawyers get such a large percentage? This is the real crux of the matter.

- Short answer: Attorneys can charge clients less because title companies pay us too.

- Long answer: Policy makers decided to call broader attention to “lawyer splits.” Yet the fees lawyers earn as title agents enable us to keep legal fees as low as possible. In our practice, we measure these fees carefully. We know the number of hours deals take and the amount of professional expertise that must be devoted to them. Were we to bill on that basis, our fees would more than double (at least) what we currently charge.

This is a lot of information to digest, and you may have more questions. If so, please don’t hesitate to contact me to discuss in more detail.

Stay Informed

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.